High commissions, 6 figure salary, and network of contacts that’s hard to beat… Wealth manager is one of the best jobs you can have in finance & banking. But the road to it isn’t easy, and only the very best will succeed at the end.

In this article I won’t discuss the steps you have to take before you can even interview for this job, such as earning some prestigious Master’s Degree and demonstrating your skills with years of experience in financial advisory or asset management.

I will focus on questions you may get in this interview, and how you should answer them to make the right impression on your interviewers, and improve your chances of getting the job. Enjoy!

Table of Contents

Can you please tell us something about your previous working experience?

An easy question for the start, an ice-breaker. You can start with your university studies (mentioning briefly the year of your graduation and degree you earned), and continue with the list of companies/funds you worked for, and positions you held there.

Hiring managers typically know all the names in the industry, so you do not have to elaborate on them. Just mention the positions you had, and, more importantly, any positive results and achievements. Beating an index by 10% is definitely something great. So is acquiring a big client (or many small clients) for your former employer.

Do not restrain from using technicalities and professional jargon in your answer. People interviewing candidates for wealth management jobs are no newbies. They will understand you, and they love to talk in their language.

Why do you want to work for our wealth management company, and not for one of our competitors?

The truth that you likely do not care. There aren’t many vacancies for wealth managers, and if you were not headhunted you simply applied with someone who advertised the job opening. As you can imagine, however, this isn’t the best possible answer for an interview.

Try to find something positive about their firm. Maybe their corporate identity and their online presentation stands out. Or they achieve better results when compared to other wealth management firms. They customer service may stand out, or perhaps some of your role models, investors you’ve been following for years, lead the company.

One way or another, they should get an impression that they are your first choice, and that you won’t leave them once you are successful, and approached by one of their competitors.

What are your strategies for acquiring new clients?

And here we come. If you expected to benefit from their existing clientele, I must disappoint you. You will benefit from the recognition of their brand, and the sum-total of money/assets they have (which allows the clients to invest into opportunities that won’t be available otherwise), but you will still have to find new clients, close new deals…

You can say that you want to rely on your existing network of clients and referrals. (I suppose you have a decent network, when you made it as far as to the interview for wealth manager job.)

But you can also say that you hope to benefit from the marketing efforts of the company and their brand, which should at least attract some people to your office, and then you will use your excellent sales skills to close the deal.

* May also interest you: Asset Management interview questions.

Here is a pen (a notepad, a mobile phone). Try to sell it to me.

At the end of day, selling is an integral part of this job. And there’s no better way of testing your sales skills then asking you to try and sell something to the interviewers.

With all your experience you probably know how to ace such a role play. You should ask a lot of questions, trying to understand what the customer seeks in a perfect pen (notepad, phone, whatever), and you should show enthusiasm for the product. You should simply try to lead a meaningful dialogue with them, and close the deal when the opportunity arises.

The most important thing is to show courage and tact. Surely it’s an interview and they do not expect a superb sales presentation from you. But they want to see that you are not afraid of selling, and have enough experience to start a sales talk in any moment.

Imagine that I gave you 1 million right now. How would you invest my dollars?

First of all, you should not fall for this trick. You need more information from them to be able to give any advice or opinion. Ask them about their goals. Why they want to invest money and what they try to achieve. What their attitude to risk is, whether they are looking for a safe investment or want to risk (and perhaps win big or lose big).

Once you have the information, you can give your opinion. Now, I do not want to outline a certain investment strategy, since I am expert an in interviewing and recruitment, and not in investing :). Surely I have my opinion but things change quickly and I do not plan to update this article each month.

In any case, you should make a proper analysis of the market before your interview. Identify both low risk and high risk opportunities. Whether you pick apartments, commodities, stocks, or even cryptocurrency, you should be able to justify your decision. That’s the most important thing.

Stock market is plummeting and an important clients calls you, saying that they want to sell everything and withdraw the funds. What will you do?

You should suggest the option that’s best not only for the clients, but also for your employer. If everybody withdraws, the fund will technically cease to exist.

Ensure your interviewers that you will do your best to talk client out of any irrational decisions they may take while panicking. We do not speak about peanuts in wealth management. Therefor you should suggest arranging a personal meeting, where you will explain everything to the client (including the fact that from long term perspective and their long term goals, selling is not a good idea).

How do you identify that your client is moving away from their financial goals?

Emphasize the importance or regular meetings and constant monitoring. Say that you want to build relationships of trust with your clients, and talk to them regularly.

Your strategy is to know everyone by name, to meet often, to discuss things and reconsider goals (following the market situation and the changes the clients experience in their lives) on the go.

Because you want to bring real value to their lives (and money to their pockets), and once they trust you and talk to you often it’s easier to keep them with the company, even if market starts to fall down… And also to notice if they are moving away from their financial goals.

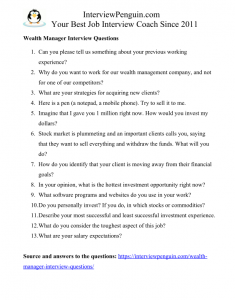

Some other questions you may face in this interview

- In your opinion, what is the hottest investment opportunity right now?

- What software programs and websites do you use in your work?

- Describe your experience using MS Excel.

- Do you personally invest? If you do, in which stocks or commodities?

- Describe your most successful and least successful investment experience.

- What do you consider the toughest aspect of this job?

- What is your desired salary?

* You can also download the list of questions in a one page long PDF, and practice your interview answers anytime later:

Conclusion and next steps

Interviews for jobs in wealth management belong to difficult interviews. You may face many tough behavioral questions, a role play, and even an IQ test, or other tests.

On the other hand, when you make it to the interview–when you actually get an invitation, it already means that they consider hiring you. Because they won’t invite any beginners.

At this level, your ability to connect with the interviewers, and to demonstrate the value you can bring to their team (whether in terms of skills or contacts) is often more important than your answers to their questions.

Do not underestimate your research, bring a quality professional portfolio, and try to prepare some answers to the questions from this article. The more time you spend preparing for your wealth management job interview, the better your chances of succeeding will be…

May also interest you:

- Private Equity interview – One of the toughest nuts to crack in finance interviews.

- Morgan Stanley interview questions.

- Goldman Sachs interview questions.