You’ve earned your degree in Accounting or Mathematics, but you find recording transactions rather boring. Numbers interest you, but you want to see behind them. You want to find the reason why company made that much, or that little money, in a given time period.

Finding interesting stories while reading financial data, and providing managers with the information they need, in order to take both strategical and operational decisions, is definitely more interesting than just recording transactions and preparing balance sheets (that’s what accountants do).

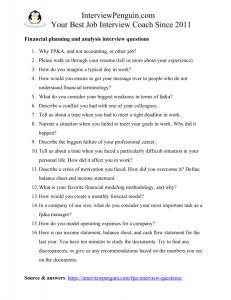

FP&A jobs are a great choice, and each bigger corporation runs an entire FP&A department. Let’s have a look at some questions they may ask you in an interview, and what you should say to get the job.

Table of Contents

Why FP&A, and not accounting, or other job?

They want to see whether you understand the difference between the two, and if you know why you actually applied.

You can say that you are rather creative, and prefer to dig deep into the numbers. Discovering the things happening behind the scenes (or behind the numbers) is more motivating for you than simply recording the financial transactions.

If you apply in a big corporation and had an accounting job before, you can also say that you prefer to try both approaches, and that after working as an accountant you’d like to try FP&A. Then you will be ready to progress to a position of a controller, or finance manager.

Please tell us more about yourself.

They do not specify what you should talk about—the choice is yours. And while some interview coaches say you should stay strictly work-related in your answer, I do not agree with their advice. You should simply focus on your strengths, while trying to make a good initial connection with the people in the room. What does it mean?

Your strengths depend on your situation in an interview. If you’ve been working as a financial analyst for four years already, or had your own accounting business before applying for this job, or if you have a degree from some Ivy League university, it makes sense to talk about such things—your education and experience is your greatest strength. But if the only position you had before was a part time role with KFC, or some side-hustle you did online, while focusing on your education, it doesn’t really make sense to talk about your working experience at length.

In such a case, you should focus on who you are, your goals and ambitions, and perhaps your abilities and personal traits, strengths that make from you a good applicant for the job in FP&A.

What’s more, it is always a good idea to share something from your personal life with the interviewers—whether you have a family, one or two hobbies you enjoy to do in your free time, and so on, just to show them that you have a life outside of work, and to demonstrate that you want to talk in an open and genuine manner in your interview…

How do you imagine a typical day in work in financial planning and analysis team?

The most important thing is to have a realistic idea of your day in work. Just like any other analyst or manager, you’ll spend a lot of time in meetings, answering emails, and doing other semi-productive tasks, many of them boring.

But you’ll spend also a significant amount of time working with profit-loss statement and cash-flow. Checking individual transactions, talking to employees responsible for them, and trying to identify any deviations, abnormalities, and trends, you’ll eventually come up with forecasts and recommendations for the company management.

Obviously the exact scope of your duties will differ from one company to another, and it also depends on your exact role within the FP&A team. If they run an entire department, you may respond just for a small part, for example analyzing certain types of transactions.

If you are the only fp&a employee, however, you’ll respond for everything I mentioned. And you will easily spend 60 hours in work each week. Or more…

How would you ensure to get your message over to people who do not understand financial terminology?

Ensure the interviewers that you do not mind stepping out of your comfort zone, explaining difficult things in a simple way. Say that you always try to adjust your language to the specialization, intelligence, and communication skills of your audience.

Using demonstration, PowerPoint presentations, and case studies and practical examples, you try to make the things simple to understand. Because you know that your work is useless, unless the others understand you…

What do you consider your biggest weakness in terms of fp&a?

You have several options for a good answer. First one is saying that you aren’t aware of any particular weakness that will restrain you from achieving great results in your work. That’s exactly the reason why you opted for financial planning and analysis, and not for some other occupation.

Second is picking something that is somehow important, but isn’t central for the job. For example, say that you are slow with MS Excel or SAP, that you lack efficiency when working with the software. Elaborate on your answer, saying that you are aware of your weakness, and hope that practice makes perfect, and that you will improve your efficiency with the software, once you start the job.

Another option is saying that you simply do not know. Surely, there are some things you can improve on, but you have to do the job first for a few weeks, to be able to tell exactly what your weaknesses are–and then you will improve on them…

Other questions you may face in an FP&A interview

* Behavioral (or situational) questions examine your attitude to various work-related situations. You will certainly get at least some of them in each interview in a big corporation. Most of the questions in the list below belong to this group…

- Describe a conflict you had with one of your colleagues.

- Tell me about an obstacle you overcame.

- Describe a situation when you used logic to solve a problem.

- Tell us about a time when you had to meet a tight deadline.

- Have you ever worked on a project that was a failure?

- Describe a crisis of motivation you faced. How did you overcome it?

- Give an example of a time you showed initiative at work.

- In your opinion, what are the current trends in FP&A?

- What are the most common challenges we face in FP&A right now?

- What was the best financial forecast and the worst financial forecast you have made in your career?

- …..

Special tip: If you aren’t sure how you’d answer the questions, or experience anxiety, but really want to succeed in your interview, have a look at a new eBook I wrote for you, the FP&A Interview Guide. Several sample answers to all 25 most common FP&A interview questions will help you streamline your preparation for this important meeting, make a great impression on the hiring managers, and eventually secure a new FP&A Analyst or Manager employment contract. You will find some excellent sample answers directly on the product page, so it makes sense to check it out even if you do not plan to purchase anything…

Technical questions in an fp&a interview

Whether you will deal with any technical questions, and the level of their difficulty, depends on several factors. The most important one is the specialization of your interviewer.

If it’s an HR Generalist, or HR manager, or a recruiter from some general agency, they won’t ask you any technical questions. Or just a few simple questions. They won’t ask you, since they do not have the capacity to assess the accuracy of your answers to technical questions.

If you apply for an entry level job in a big corporation, you typically won’t face any technical questions either. Such corporations have excellent training programs. You will learn the technical stuff before starting the job.

They care more about your general intelligence, communication skills, motivation, and attitude to work. These are tested with a different set of questions (personal and behavioral).

Interview with an expert

However, if a senior analyst, accountant, or financial manager leads your interview, or if you apply for a lone FP&A vacancy in a corporation, you may get some technical questions.

Once again, their difficulty depends on the knowledge and experience of your interviewers, as well as on your future role in the company (and the level of independence you’ll have in the job). We analyze most of them in the eBook, here is a short selection:

- What is your favorite financial modeling methodology, and why?

- What profitability models have you used for forecasting a project?

- Are you familiar with developing business casing and ad-hoc analysis?

- How do you model operating expenses for a company?

- Here is our income statement, balance sheet, and cash flow statement for the last year. You have ten minutes to study the documents. Try to find any discrepancies, or give us any recommendations based on the numbers you see on the documents.

- ….

Special Tip: You can also download the full list of questions in a one page long .PDF, print it, and practice your interview answers anytime later:

Conclusion and next steps

Interview for a job of FP&A Analyst, or of FP&A Manager, belongs to difficult job interviews. It goes about a popular job field, and you will typically compete with many other people for the position.

What is more, interviewers will test you with a set of personal, behavioral, and sometimes also technical questions. Short case studies are nothing uncommon, especially if we talk about job interviews in big corporations.

Try to prepare for the questions. Success in this interview is not a question of luck. Unless you prepare well, you cannot expect to outclass the other job candidates and get the job… And if you’d like to get some professional help, consider checking out my eBook, FP&A Interview Guide. Thank you, I wish you best of luck!

Matthew Chulaw, Your personal interview coach

May also help you:

- Financial Controller Interview – Overseeing an entire accounting department of any middle sized or big corporation is not a small task, and you will have to pass a tough one to get this job.

- How to handle interview nerves – Feeling anxious? Learn how to get rid of your interview stress.