Overseeing an entire accounting department of any middle sized or big corporation is not a small task. It’s a job for experienced and certified accountants, people who know the ins and outs of business. People who can spot a mistake nobody else in a company would spot.

You will enjoy a hefty compensation as a Financial Controller, but you will also respond for a lot of things. What is more, not everyone in the corporation (or in a public institution, should you work for one on this job) will like you. You will be the one who points out their mistakes. Internal auditors may make regular checks, but you will control the finances on an ongoing basis.

All of this will be reflected in a questions they will ask you. Questions about your experience, technical questions or even some case studies to check your accounting skills. But they will also behavioral questions, to understand how you would approach difficult interpersonal situations that belong to this job.

Let’s have a look at some of these questions. I will show you how to answer them.

Table of Contents

Why did you apply for a job of a Financial Controller?

Because the payment is amazing, because you love to be on the top, and because there’s hardly a better job you can get with your qualification. These are perhaps the real reasons (at least the reasons in the depth of your heart), but you should speak about different motives in your interview.

Say how long you’ve been working as an accountant, or an auditor, and how these roles prepared you for the position. Say that you’d love to have great responsibility, and feel ready to keep the entire accounting department efficient and deadly accurate.

You can even say that someone from the company recommended you or headhunted you (often the case for this position). If so, they probably know what they are doing. If you have any references from your past employers that testify to your excellent accounting skills, you can show them to the interviewing panel.

Sample answer:

I just feel that with all the years of accounting and auditing experience, in both public and private sector, I am ready for the next step, and perhaps the biggest role of my life. What’s more, I see a meaningful purpose in this job. Public institutions operate with public money, and not small sums, which is the case here. As a controller here I can help to make sure that the public money is used in the best possible way, for the benefit of the local community and people of the city. It is very motivating to me. Of course, the remuneration package is great too, but it isn’t the main reason for my application.

Please tell us something about your previous working experience.

What executives and top managers love to hear when recruiting for important positions is a story. A story of your career that starts with degree in accounting (or relevant field), experience in one of the big four companies, CPA exam, some successes and failures you experienced, and lessons you learned in your past jobs. All of it should eventually result in your job application.

Your story should make sense, and convince them of your readiness for the job. Remember that interviewers observe a lot of things while talking to you. Do you talk systematically? Can you speak about financial things in a non-technical way? Will your new colleagues understand you? Are you enthusiastic about your career and what you want to achieve in your new occupation? Keep it on your mind while talking about your past experience…

Sample answer:

As you can see on my resume, I started from the very bottom in one of the big 4 companies. I was one of the many trainees with big dreams and ambitions. And I can say that I made them come true. Worked harder than others, built great relationship with my clients, attended courses in my free time, got the CPA, you name it. Then more opportunities came, job of an FP&A manager, later leading the entire FP&A department with 10 employees. My career, and the successes I have achieved on various positions [you narrate one or two of your principal achievements], have prepared me for the role of a Financial Controller–at least I believe so. And that’s where we are now in the story of my professional career–everything culminates in this interview, and I hope for a good outcome.

How do you imagine a typical day in work, as a financial controller in our business?

This obviously depends a lot on the size of the institution, and whether it is public or private. However, while you may respond for recruiting accountants and analysts in some companies, and for many other things, the core of your work will always consists in the same thing: ensuring that all accounting allocations are appropriately made and documented.

That means that you’ll spend most of your days either studying the existing financial documents (going as deep as on a level of individual invoices and receipts), or suggesting how new transactions should be made, to be most effective for the company.

So, say that you plan to spend part of your days with other staff members. You will ask for documentation of each transaction. The rest will be spent in your office. You will be checking these documents, and comparing them with the data in the books. Verifying whether they are properly documented, and reflect the real revenues and expenses, you will look for discrepancies.

Sample answer:

I do not have any fancy expectations. Obviously the majority of my day I will spend inspecting all financial transactions in this organization, to the level of individual invoices, checks, and so on. It involves a lot of diligent work, and hours in front of a computer screen. But I know it is the integral part of the job. Besides that I imagine interviewing some employees, and having meetings, though in a role of a controller it is pivotal to remain independent, at least to a huge degree. I also believe that planning and designing new processes of allocating funds and making transactions effectively also forms an important part of the job, and definitely imagine spending some time doing that.

Idea: Download 10 questions in a one page long PDF, and practice your interview answers anytime later (even when offline):

Imagine you found an important discrepancy in documents provided by one of the top executives of the company. What would you do?

Financial controller should stand on the outside of the corporate hierarchy. They should respond to the board and nobody else. This is the only way to ensure that they can do the job properly without fearing of losing their job.

Because of that I suggest you to say that you would report it to the board (or CEO if there’s no board), and let them to decide what they would do with the executive. At least that’s what expected from the controller in most cases…

Sample answer:

When doing my job, I do not care who is responsible for the discrepancy. My goal is to discover them, and, depending on their severity, report them to the management or board and let them take the action. And I would do exactly this should I find any important discrepancy provided by one of the top executives, or even directly by the CEO of the company.

What are your expectations on internal auditor, accountants, and other employees in an accounting department?

First and foremost, you should expect a lot from one person only–yourself. You will be the most experienced person in the company as far as accounting goes, and you really should not expect any sort of help from accountants or auditors. Or from anyone else.

Different bodies follow different goals in the company. You should try to stay outside of the maze, and control each one of them, in terms of corporate finances and what they do with them. What you can say, however, is that you expect them to be transparent, to keep the documents such as invoices and receipts, and to talk to you openly and provide information you asked them for.

Sample answer:

The only thing I really expect from them is transparency, and willingness to provide any documents I may need from them for my work. That’s all. I definitely do not expect them to help me with my job, since they are also employees of the organization and my job is to control the transactions of everyone. Or at least that’s how I see it…

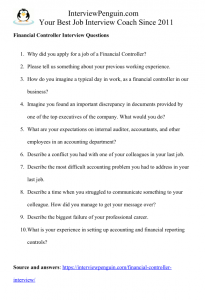

Other questions you may face while interviewing for a financial controller job

- Describe a conflict you had with one of your colleagues in your last job.

- Tell us about the most difficult accounting problem you had to address in your last job.

- Describe a time when you struggled to communicate something to your colleague. How did you manage to get your message over?

- What does integrity mean to you?

- Describe the biggest failure of your professional career.

- What is your experience in setting up accounting and financial reporting controls?

- Tell us about a time when you showed initiative at work.

- Tell us about a time when you faced a conflict of personal and professional interests in your work.

- How do you define quality?

- Tell us about a time when you had to make a decision without all the information you needed.

- Describe a situation when you used logic to solve a problem.

- Why shouldn’t we hire you?

Special tip: Not sure how to answer the behavioral questions, “tell us about a time when…”, “describe a situation…”, etc? Have a look at our Interview Success Package, where you’ll find up to 10 brilliant answers to more than 100 interview questions, including 30+ behavioral questions–basically everything a hiring manager can throw at you in an interview for a Financial Controller job.

What’s more, these are premium answers, not available to general public. They will help you stand out in an interview and outclass your competitors–something you typically have to do, when trying to get a prestigious job like the one of a Financial Controller.

Conclusion and next steps

Your experience counts more than anything else in an interview for a position of financial controller. But it is not only about what you did. It’s more about being able to explain how your past employers benefited from your work. And ensuring the interviewers that you can transfer this knowledge to your new job.

You will typically interview in front of a panel, which is always more stressful, and they will for sure ask you some behavioral questions, trying to understand how you’d deal with difficult situations that happen in a daily job of a controller.

I would not say that this interview is particularly difficult, but I would say that each company chooses their new controller cautiously.

They won’t hire you just because they have nobody else applying for the job, or because they need a new controller quickly. They will take their time, they will do the reference check, and they will “grill” you with some tough behavioral questions. Try to get ready for the challenges. I hope you will succeed, and eventually sign a great job contract. Good luck to you!

Matthew

May also interest you:

- Assistant controller interview questions.

- Finance manager interview questions – Some questions overlap with interview questions for controllers. Learn how to answer them.

- Compliance officer interview questions.