The typical America household carries an average debt of $140,000. People aren’t patient. They want new cars, big houses, luxury holidays, and they want them now, to satisfy the never-ending pursuit of an illusion of happiness. And they are not going to wait for ten years to get the next shiny thing. They will simply get a loan and hit the purchase button. And then they will repeat the same process again and again, trying to find balance and joy where it cannot really be found.

You do not have to be afraid about your future as a loan processor. People will always apply for loans and mortgages, and you will have plenty of work on your desk. And you can also make a lot of money, because on the top of your regular salary (typically starting at $40,000 annually, before tax), you will get an extra commission for each file you process. Let’s have a look at questions you may face while interviewing for this interesting position.

Table of Contents

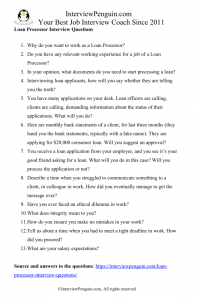

Why do you want to work as a Loan Processor?

You should talk about the value you want to bring to your new employer, and not only about things the job will bring to you, such as an excellent salary (considering your level of education), and flexibility it offers. Try to connect your skills and interests with the benefits they will get from having you onboard.

They should feel that you apply because you believe to have what it takes to be an excellent loan processor—attention to detail, responsibility, great time management skills, and so on.

Sample answer:

I believe to have the right skills for the job, and I really enjoy the banking environment. I understand that people will always need loans, and see a bright future for this career field. Reading the job description carefully, and comparing the job requirements with my skills, I honestly believe that this is the right job for me, at least at this stage of my career. Maybe later on I can become a loan officer, or progress even further in my professional career. But with my education the only option is starting from the bottom, and build up from there.

Do you have any relevant working experience for a job of a Loan Processor?

Mark my words: anything you did with people, or with documents, is a relevant experience. You just have to find the connection and explain it to your interviewers in a meaningful way. You worked as an administrative assistant before? That’s a relevant experience, because you spent a lot of time reviewing and retyping documents, you learned to work with computer software such as MS Excel, and you certainly improved your attention to detail while having the job. You will benefit from these skills as a Loan Processor.

You had a job in HR before, or perhaps taught at school? Even this is relevant, because you talked to people, led interviews, and you learned to recognize the signals when someone is telling the truth, and when they are lying.

Remember, all banks and other lenders have a training program for new loan processors in place. They do not expect you to start in the job from day one and excel. But they will be happy to see that you have at least some experience with similar type of work, and your task is to convince them that you have such an experience–regardless of the job you had before.

Sample answer:

In my opinion, every experience helps, since everything related to everything else. I worked as an office assistant in a small company before. Did a lot of paperwork, spent hours working with MS Excel, communicated with clients, took care of meeting the goals. Though it may seem like a completely different job, I believe it actually helped me to prepare for the role of a Loan Processor. What’s more, I know you have a great training program in place and no doubt I will learn the ins and outs of the job quickly.

In your opinion, what documents do you need to start processing a loan?

The more documents you mention, the better. They should get an impression that you do not plan to take your job lightly. In order to minimize the number of mistakes, you’ll try to get everything you can from the applicants. For example:

- Tax returns (this is important especially for corporate customers)

- Pay stubs, W-2s or other proof of income

- Bank statements and other assets, ideally for the last six months at least

- Credit history–self explanatory

- Gift letters

- Photo ID, in an ideal case 2 IDs

- Renting history

- ….

Special Tip: To know how to answer the question, and to come up with a good and genuine answer in an interview, are two different things. If you experience anxiety, or aren’t sure what exactly you should say in your interview to get the job, have a look at a new eBook I wrote, the Loan Processor Interview Guide. Multiple great answers to 25 most common loan processor interview questions–basically any questions you may realistically face, will help you streamline your preparation for the meeting with the hiring managers, and walk away with a new employment contract. Thank you for checking it out!

How do you make sure you make no mistakes while processing the loan applications?

Mistakes prove costly in this job—extremely costly. And while underwriting software helps us to minimize the mistakes—the algorithm will decide whether an applicant gets a loan, or a rejection, it is still you who collects the data from the clients, and verifies their authenticity.

Ensure the interviewers that you are aware of your responsibility. You can say that you will double check everything with the applicants. You can also emphasize that when something looks strange or unrealistic, you’ll verify the data with another source, ideally more than one, just to be 100% sure. One way or another, they should feel that you want to minimize the number of mistakes, or eliminate them completely.

Sample answer:

I pay special attention to detail, and it will certainly help me to avoid mistakes in this job. What’s more, I want to stick to the process invariably, in terms of verification of the documents, and the exact steps I should take while working on a file. I am well aware of the consequences any mistake in this job can have on lives of many people, as well as of the existence of mortgage fraud. That’s why I will stick to the processes of verification and double check everything, leaving no place for mistakes.

You have many applications on your desk. Loan officers are calling, clients are calling, demanding information about the status of their applications. What will you do?

Precision matters more than speed in this job. And while customer service is important, you should never lower your quality standards just to please the customer, or to get the job done before the end of a working day.

Tell the interviewers that you will calmly explain them that they have to wait, that your work is not finished yet. You kindly ask them to not call again–you need to focus on your main work, after all, which is gathering and analyzing the documents, and not answering phone calls.

Hence you will follow the standard procedure with each application, and won’t let other people to get into your head, or to stress you out. You can say though that you may work overtime when the workload is heavy. Showing your willingness to sacrifice something for your job and employer is never a bad idea in the interviews.

Sample answer:

First of all, I understand that we live in a fast-paced world, and people have almost completely lost their patience. What’s more, I also understand that other people have their deadlines, and if waiting for a file from me decides whether they meet their deadline or not, they may call me. At the same time, however, precision matters more than speed in this job. I cannot do some document check lightly just to get it done quickly. Hence I will kindly ask them for patience, and also to not call me another time, since I have to focus on the core of my job and not on answering phone calls.

How do you imagine a typical day in this job?

Having a cup of coffee, reading newspapers, sitting in a comfy massage chair in your pajamas, and waiting for a phone to ring. Is this your idea of a job of a loan processor?

Well, you’ll have to show a different attitude in your interview—at least if you want to get hired.

Speak about proactive approach to work—making calls, contacting clients, doing yet another verification of the file, sending messages to the underwriter, ensuring about the progress, etc.

Obviously the day looks slightly differently in each place. In some cases, you may have someone organizing the day for you, giving you precise instructions in a short daily meeting, or on a daily call. In other cases, once your training is over, they will simply assign you clients and you’ll be on your own in the organization of the day.

However, the interviewers always want to hear about your proactive approach to work.

Show them that you are not afraid to step out of your comfort zone, and do something extra for your employer, or for the clients. Job description may also help you to understand how your day will look like, though banks have a tendency to advertise overly-complicated job descriptions…

Sample answer:

I like to be organized in work, and I will definitely try to make a schedule for each day, from morning to evening. The principal part of the day will be devoted to going through the applications, and taking care of the verification process. That obviously includes many phone calls to different bodies and institutions. Needless to say, once we verify things, we have to enter everything to the computer, and verify the accuracy again. Hence my idea is spending a lot of time in front of a computer screen, and on the phone, making sure that I progress with the loan applications and meet the deadlines.

Other questions you may face in your loan processor job interview

- You receive a loan application from your employer, and you see it’s your good friend asking for a loan. What will you do in this case? Will you process the application or not?

- Describe a time when you struggled to communicate something to a client, or colleague in work. How did you eventually manage to get the message over?

- Have you ever faced an ethical dilemma in work?

- Tell me about a time you had to comply with a policy or procedure that you did not agree with.

- What does integrity mean to you?

- Tell us about a time when you had to meet a tight deadline in work. How did you proceed?

- How do you deal with rejection? How do you feel about rejecting an application of someone you like as a person?

- It is hard to ensure the compliance of the documentation requirements, and at the same time provide an excellent customer service. How do you think we can do that?

- …..

Conclusion, great answers to all questions

Interview for a job of a Loan Processor belongs to interviews with average difficulty. Most companies who hire loan processors have excellent training programs in place, and they won’t test your loan processing skills with some tricky technical questions.

On the other hand, they will ask you some behavioral and scenario based questions, trying to understand your attitude to work, and basically see the differences between you and other job candidates–typically many, because Loan Processor is a decent job with low entry requirements.

Try to prepare a good answer to each question you may face. And if you struggle, or experience anxiety, or simply want someone with years of interviewing experience to make the entire process easier for you, have a look at a new eBook I wrote for you, the Loan Processor Interview Guide.

Multiple great answers to all questions you may realistically face in this interview will help you relax, and deliver your very best in the meeting with the hiring managers. Thank you for checking it out, and I wish you good luck!

Matthew Chulaw, your personal interview coach

* You can also download the questions in a one page long PDF, and practice your interview answers anytime later:

May also interest you:

- How to overcome interview nerves – Stress can easily kill your chances in an interview. Learn how you can overcome it and deliver your best on the big day.

- Salary negotiation tips – Get as much as you deserve, or even more… Learn how to convince the hiring managers of the value you’d bring to their business.

- Loan officer interview questions – Some questions overlap with questions for processors. Check them out and get ready for your interview.